Posted on

March 9, 2025

by

Marie Taverna

According to the Royal LePage® House Price Survey released today, the aggregate1 price of a home in Canada increased 3.8 per cent year over year to $819,600 in the fourth quarter of 2024. On a quarter-over-quarter basis, the national aggregate home price remained essentially flat, rising a modest 0.5 per cent. When broken out by housing type, the national median price of a single-family detached home increased 4.9 per cent year over year to $855,900, while the median price of a condominium increased 1.5 per cent year over year to $592,700. While activity began to flourish again in the final months of 2024, following sluggish demand in most major markets over the summer, home price appreciation remained in check last quarter. “There are several converging factors revitalizing Canada’s real estate market and making home ownership more attainable,” said Phil Soper, president and CEO, Royal LePage. “Interest rates have fallen sharply in recent months, with further reductions expected in 2025. At the same time, new mortgage rules are already helping younger Canadians by increasing borrowing power and reducing monthly carrying costs. “Year over year activity levels were up sharply in Canada’s largest cities during the fourth quarter, with national home sales volumes exceeding the ten-year moving average for the first time since the post-pandemic market slowdown began three years ago,” said Soper. “As sidelined buyers regained confidence and took advantage of improved affordability, momentum built steadily through the final months of 2024. “We expect stronger demand to persist through the winter, setting the stage for an early and active spring season,” continued Soper. “Home prices are likely to trend only modestly upward over the coming year as inventory is absorbed. This is welcome news for buyers, who can look forward to a more balanced market compared to the frenzied conditions of 2021 and 2022.” Royal LePage is forecasting that the aggregate price of a home in Canada will increase 6.0 per cent in the fourth quarter of 2025, compared to the same quarter last year. 1 Aggregate prices are calculated using a weighted average of the median values of all housing types collected. Data is provided by RPS Real Property Solutions and includes both resale and new build. Learn more:

Posted on

March 9, 2025

by

Marie Taverna

At first, your home may have felt like true love – the perfect match, full of excitement and possibility. But as time goes on, the honeymoon phase can fade. Maybe you’re craving more space, a shorter commute to work or school, or modern features that other homes seem to have. If you’re feeling restless, you might be wondering, “Is it time for a fresh start, or can this relationship be saved with a little TLC?” Deciding whether to move to a new home or renovate the one you’ve got is no small decision — it’s a mix of emotions, finances, and practicality all rolled into one. Think of it like the HGTV classic Love It or List It: weighing the pros and cons of both options to figure out what truly fits your family and lifestyle. This guide will help you determine if your home is still “the one” or if it’s time to move on. Top reasons to renovate your homeIf you love your neighbourhood, have sentimental attachments to your home, or see potential in upgrading your space, renovating might be the better option. Here’s when improving makes sense: 1. Your home has good bonesIf your home is structurally sound and doesn’t require major foundational work, a renovation could be a cost-effective way to address your needs. Open up your floor plan, update outdated features, or add square footage to create a home that feels brand new. 2. You love your locationIf your home is in a desirable neighbourhood, close to work, or within a top school district, improving your home allows you to enjoy these benefits while adapting your space to meet your needs. 3. Renovations increase valueConsider renovations that will add significant value to your property. Projects like modernizing the kitchen, updating bathrooms, or adding energy-efficient upgrades often provide a good return on investment. 4. Moving costs are prohibitiveBetween realtor fees, closing costs, and moving expenses, relocating can be expensive. If your renovation budget is less than the cost of moving, it might make more financial sense to stay put. Top reasons to move to a new homeSometimes, no amount of renovation can fix a home that no longer suits your lifestyle. Here’s when moving to a new property may be the better option: 1. Space is limitedIf your family has outgrown your current home and there’s no room to expand, or zoning restrictions make it impossible to do so, moving to a larger property may be the best solution. 2. Your needs have changedLife changes – like a growing family, a new job, or aging parents moving in – may make your current home impractical. In these cases, finding a home that meets your new needs can be more effective than extensive renovations. 3. Renovations are too costlyIf the renovations required to make your home suitable are extensive and expensive, the ROI might not justify the investment. In this case moving may be more cost-effective. 4. You’re ready for a changeSometimes, the desire for a fresh start or a completely different style of home outweighs the convenience of staying. If you’re feeling uninspired or constrained in your current home, it might be time to explore new options. Key questions to help you decide whether to renovate or relocateStill stuck between renovating and relocating? Here are a few crucial questions to ask yourself to find an answer. 1. What’s my budget? Compare the costs of renovating versus moving. Don’t forget to factor in hidden costs like permits, temporary housing, or realtor fees. 2. How disruptive will renovations be? Living through major renovations can be stressful and time-consuming. Consider whether you have the time and patience for the process. 3. Will I get the features I want? If your renovation can’t deliver your dream home, moving may be the better choice. 4. How long do I plan to stay? If you plan to stay in your current home for many years, renovations could be a worthwhile investment. If not, moving might make more sense. How we can support your decisionThe choice between moving and improving is deeply personal and depends on your unique situation. By evaluating your needs, budget, and long-term goals, you can make a decision that works best for you and your family. Whether you decide to renovate or relocate, having the right team on your side makes all the difference. Royal LePage professionals specialize in helping homeowners navigate these pivotal decisions. From finding trusted contractors to discovering your dream home, they’re here to guide you every step of the way.

Posted on

March 9, 2025

by

Marie Taverna

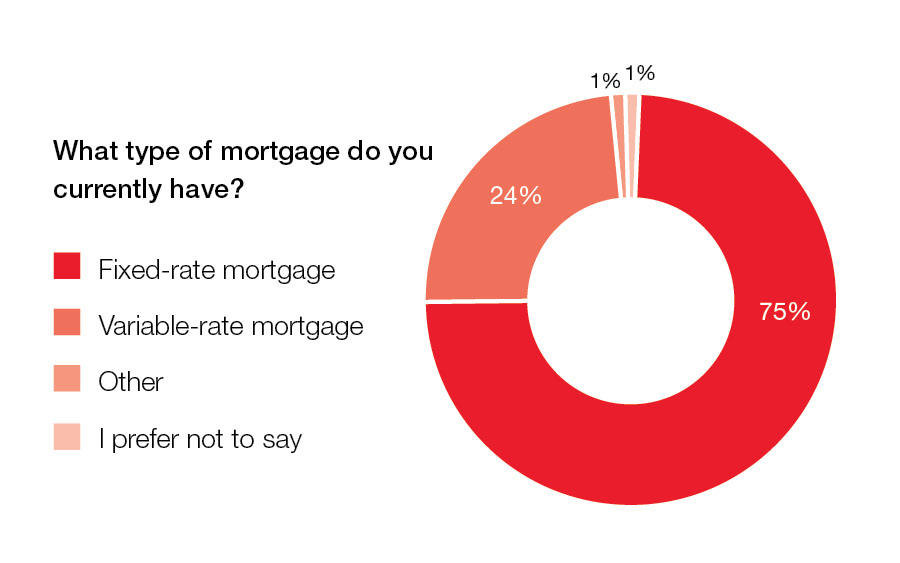

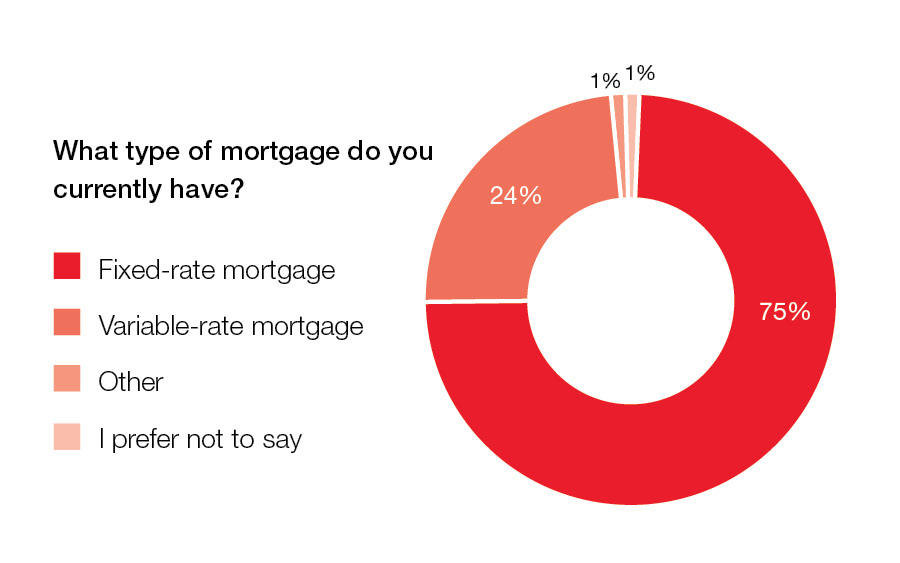

More than half of Canadian borrowers anticipate their monthly mortgage payment to increase upon renewal in 2025More than a million Canadian mortgages will come up for renewal this year. Though interest rates have been on the decline for the last several months, many borrowers are bracing for an increase to their monthly payment – an adjustment that could be quite steep for some households. According to a recent Royal LePage survey, conducted by Hill & Knowlton,1 more than half (57%) of Canadians who are renewing the mortgage on their primary residence in 2025 expect their monthly mortgage payment to increase upon renewal (35% expect it to increase slightly and 22% expect it to increase significantly). Meanwhile, 25% say their monthly mortgage payment will remain about the same – within $100 of their current payment amount – and another 15% expect their monthly payment to decrease upon renewal. “When it comes to post-pandemic mortgage renewals, many Canadians have avoided the worst-case scenario of having to sell their homes due to the inability to cover the cost of their mortgage, thanks to solid employment trends and declining interest rates,” said Phil Soper, president and CEO, Royal LePage. “Nevertheless, some will face a substantial rise in their mortgage costs, putting added pressure on their household finances. Many in this situation are exploring options to lower their monthly fees, such as extending their amortization period; a tactic which has proven popular.” Of those who expect their monthly mortgage payment to rise upon renewal, 81% say the increase will put financial strain on their household; 47% expect a slight strain, while 34% expect a significant strain. Though many Canadians will see their monthly mortgage payment rise this year, most see no reason to make preemptive major lifestyle changes to cope with increased housing expenses. A majority (62%) of respondents say they will not change their living arrangements to avoid potentially higher monthly mortgage costs. Respondents in Quebec were the most likely to say they will not adjust their living arrangements (78%), while those in Alberta were the least likely to say so (53%). Nationally, however, 11% say they are considering relocating to a more affordable region; 10% say they are considering downsizing; and 10% say they are considering renting out a portion of their home to subsidize expenses. Respondents were able to select more than one answer. Variable-rate mortgages rise in popularityWith interest rates on a downward trajectory, variable-rate mortgages are gaining in popularity. According to the survey, 66% of Canadians with a mortgage renewing this year say they plan to obtain a fixed-rate loan upon renewal (down from the 75% who currently hold fixed-rate mortgages), and 29% say they will choose a variable-rate loan (up from the 24% who currently hold variable-rate mortgages). While most Canadians with pending renewals in 2025 plan to stick with the same type of mortgage product they currently have, a sizable shift toward variable-rate loans has emerged. Of those who currently have a fixed-rate mortgage renewing this year – the most popular mortgage product overall in Canada – 20% say they will switch to a variable-rate loan. Seventy-six per cent say they intend to renew with another fixed-rate loan. Meanwhile, 61% of current variable-rate mortgage holders intend to renew with another variable-rate loan, and 37% say they will switch to a fixed rate.  “Since last summer, the Bank of Canada has made several cuts to its overnight lending rate amounting to a decline of 200 basis points thus far, driving variable mortgage rates down in tandem. For homeowners looking to reduce their monthly payments or pay down their principal faster, variable-rate mortgages have become an increasingly attractive option in light of today’s declining rate environment and the likelihood of further cuts this year,” added Soper. “Ultimately, Canadians should choose the mortgage product that best suits their financial goals and risk tolerance.” Read the full press release and review the data chart for more information and regional insights: PRESS RELEASE DATA CHART

Royal LePage resources for those renewing their mortgage

Posted on

March 9, 2025

by

Marie Taverna

Move in by Spring 2025! The “TERRACES” CUTE 1 bed & den unit, perfect for a 1st time buyer or empty nester wanting to downsize, or anyone in between .From the moment you walk in you will love the nature light streaming in.Large living room with wood burning fireplace. Sliders to balcony facing south & enjoy view to Metro Town. Cozy kitchen with stain glass window. Dining room with retro light fixture. Good size primary bedroom with walk through closet to 4-piece bath. Bonus, den/office/guest bedroom/shoe closet, you decide! Laundry closet, just add washer & dryer. Also a shared laundry room in the building. Easy care flooring.1 parking spot.1 Locker on the same floor as unit. Transit, shopping & recreation close by. Great for students commuting to SFU or BCIT. Book a first date to view this condo. Was listed at $515,000.00

Posted on

March 9, 2025

by

Marie Taverna

After a 46 per cent year-over-year increase of new listings in January, the number of newly listed properties on the MLS® in Metro Vancouver* rose more moderately in February helping keep market conditions in balanced territory.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,827 on Metro Vancouver’s Multiple Listing Service® (MLS®) in February 2025, an 11.7 per cent decrease from the 2,070 sales recorded in February 2024. This total was 28.9 per cent below the 10-year seasonal average (2,571).

“After the rush of new listings in January, home sales and new listings in February were closer to historical averages, which has positioned the overall market in balanced conditions,” Andrew Lis, GVR’s director of economics and data analytics said. “With a potential Bank of Canada rate cut on the table for mid-March, homebuyers may find slightly improved borrowing conditions while enjoying the largest selection of homes on the market since pre-pandemic times.”

There were 5,057 detached, attached and apartment properties newly listed for sale on the MLS® in February 2025. This represents a 10.9 per cent increase compared to the 4,560 properties listed in February 2024. This was 11.6 per cent above the 10-year seasonal average (4,530).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 12,744, a 32.3 per cent increase compared to February 2024 (9,634). This is also 36.4 per cent above the 10-year seasonal average (9,341).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for February 2025 is 14.8 per cent. By property type, the ratio is 10.7 per cent for detached homes, 18.5 per cent for attached, and 16.8 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“Balanced market conditions typically bring a flatter price trajectory, and we’ve seen prices across all segments remain in a holding pattern for the past few months,” Lis said. “But with the active spring season just around the corner, it will be interesting to see whether buyers take advantage of some of the most favorable market conditions seen in years, and whether sellers change their willingness to bring their properties to market.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,169,100. This represents a 1.1 per cent decrease over February 2024 and a 0.3 per cent decrease compared to January 2025.

Sales of detached homes in February 2025 reached 477, a 14.8 per cent decrease from the 560 detached sales recorded in February 2024. The benchmark price for a detached home is $2,006,100. This represents a 1.8 per cent increase from February 2024 and is virtually unchanged compared to January 2025.

Sales of apartment homes reached 976 in February 2025, a 10.6 per cent decrease compared to the 1,092 sales in February 2024. The benchmark price of an apartment home is $747,500. This represents a 2.8 per cent decrease from February 2024 and a 0.1 per cent decrease compared to January 2025.

Attached home sales in February 2025 totalled 359, a 10.9 per cent decrease compared to the 403 sales in February 2024. The benchmark price of a townhouse is $1,087,100. This represents a 1.2 per cent decrease from February 2024 and a 1.7 per cent decrease compared to January 2025.

| | Download GVR's February 2025 MLS® stats package |

Posted on

February 13, 2025

by

Marie Taverna

Welcome to “The Shaughnessy” in West Coquitlam. This top floor condo unit has two bedrooms & two baths. You will be impressed with the 15+ feet vaulted ceiling in the living room & wood burning fireplace. The living room & dining room are perfect spot for entertaining friends. Cute kitchen with Stainless Steel fridge & stove. Good size primary bedroom with walkthrough closet to in suite laundry. The four-piece bath & a two-piece bath flow together. Easy care tile floors thought most of unit. In suite storage or reno to a cute little office. Second bedroom or den. Enjoy many hours in the summer on your balcony among the tall trees. Centrally located to transit and shopping. The SkyTrain is a short stroll away. Flat walking neighbourhood. One underground parking spot. OPEN HOUSES SATURDAY FEBRUARY 15th & SUNDAY FEBRUARY 16th from 2:00-4:00pm. See you there!

Posted on

February 10, 2025

by

Marie Taverna

SURREY, BC – Growing inventory and stable prices could lead to opportunities for buyers in the Fraser Valley market this winter despite uncertain economic conditions. Newly listed homes jumped 167 per cent from December to January, with 3,432 listed on the Fraser Valley Real Estate Board’s Multiple Listing Service® (MLS®). At 7,251 active listings, inventory is at a 10-year seasonal high, 54 per cent above the 10-year average. While sales remained slow in January, with 818 properties sold (down 18% from December), the combination of stable prices and abundant selection presents potential opportunities for buyers to get back into the market. The sales-to-active listings ratio appears to bear this out. At 11 per cent, the overall ratio is signaling a buyer’s market, with detached homes firmly in buyer’s market territory. The market is considered to be balanced when the ratio is between 12 per cent and 20 per cent. It took longer to sell homes in January compared to December. Across the Fraser Valley, the average number of days to sell a single-family detached home was 52, while for a condo it was 42. Townhomes took, on average, 38 days to sell. “The market appears to be in a holding pattern at the moment,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “There is no doubt that economic uncertainty is playing a role, especially the spectre of a trade war, which could lead to even more rate cuts by the Bank of Canada. The confluence of these conditions could provide unique buying opportunities, but we urge buyers and sellers to work with a REALTOR® to ensure they align with financial objectives.” Benchmark prices in the Fraser Valley held relatively steady in January, with the composite Benchmark price down 0.03 per cent to $964,800. To read the full statistics package, click here.

Posted on

February 10, 2025

by

Marie Taverna

With the arrival of a new year comes fresh trends and design inspiration – you might already be feeling the urge to redecorate or dive into DIY projects for your home in the months ahead. One of the easiest and most impactful ways to transform a room is through colour. A fresh coat of paint can instantly set the tone, adding warmth, energy, or a sense of calm, depending on your choice. So why not take inspiration from the most stylish hues of the year? Whether you’re looking to give your home a contemporary edge or a timeless refresh, here are some of the must-have colours for 2025. For those seeking to add a touch of richness to their walls, Pantone’s Mocha Mousse offers a luxurious, subtle brown shade. Described as indulgent and comforting, this earth tone pairs well with floral colours like sage green, dusty pink, and cornflower blue, or similar natural tan and nude hues. Its warm undertones create a cozy ambiance, making it an excellent choice for living rooms, bedrooms, and even home offices. This bold and deep ruby red by Behr is perfect for those looking to make a striking statement on their walls. Warm and rich, Rumors offers a dramatic yet inviting touch, effortlessly balancing vibrancy with sophistication. Its versatility allows it to be paired with both warm and cool tones, creating depth and contrast in any space. Rumors can be applied to ceilings, baseboards, and moldings for an unexpected yet stylish pop of colour. Heathery, dusty, and velvet-like, Cinnamon Slate by Benjamin Moore is a sophisticated fusion of earthy browns with subtle plum undertones. This rich, nuanced shade exudes warmth and comfort, making it a perfect choice for those looking to create a cozy yet refined atmosphere. Pairing nicely with warm browns, soft creams, and muted mauves, Cinnamon Slate is a calming addition to any living room, bedroom or dining room wall. Valspar’s Encore is a crisp, cool shade that brings refreshing energy to any space. Under low lighting, its subtle violet undertones add depth, making it an ideal choice for a powder room, basement, or an accent wall. This versatile blue pairs beautifully with cream for softness, rich browns for warmth, or muted sage for a natural touch, creating a balanced and sophisticated colour palette. Embracing the resurgence of maximalist design, Purple Basil by Glidden is a statement-making hue that exudes self-expression, richness, and confidence. Departing from traditional neutrals, this deep, sophisticated purple draws inspiration from retro colour palettes and striking pastels, bringing a sense of nostalgia with a modern twist. Purple Basil can be elevated with gold accents for an opulent feel, balanced with muted gray-greens and blues for a grounded aesthetic, or softened with creamy grays for a more understated elegance. Why choose just one Colour of the Year when you can have nine? To mark the 15th anniversary of its first Colour of the Year announcement, Sherwin-Williams has unveiled a curated selection of its top shades for 2025. This dynamic palette – featuring Grounded, Sunbleached, Chartreuse, Bosc Bear, White Snow, Rain Cloud, Clove, Malabar, and Mauve Finery – offers endless possibilities for mixing and matching, allowing homeowners and designers to create beautifully layered, personalized spaces. ContributorMichelle McNallyCommunications manager, Royal LePage Michelle is a member of Royal LePage’s Communications and Public Relations team, and works to deliver unique and insightful Canadian real estate content to media and consumers. Prior to joining Royal LePage, Michelle was an online reporter specializing in Canadian real estate and pre-construction development. She is a graduate of Toronto Metropolitan University’s esteemed journalism program.

Posted on

February 10, 2025

by

Marie Taverna

Homes newly listed on the MLS® in Metro Vancouver* rose 46 per cent year-over-year in January, as sellers appear eager to enter the market to start the year. SalesThe Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,552 in January 2025, an 8.8 per cent increase from the 1,427 sales recorded in January 2024. This was 11.3 per cent below the 10-year seasonal average (1,749). "In the three months preceding January, we’ve watched buyer demand gain momentum, but it appears that momentum is now shifting toward sellers to start the new year. Even with this increase in new listing activity, sales continue to outpace last years’ figures, signaling some buyer appetite remains after the upswing that finished off 2024."Andrew Lis, GVR director of economics and data analytics ListingsThere were 5,566 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in January 2025. This represents a 46.9 per cent increase compared to the 3,788 properties listed in January 2024. This was 31.1 per cent above the 10-year seasonal average (4,247). The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 11,494, a 33.1 per cent increase compared to January 2024 (8,633). This is 33.2 per cent above the 10-year seasonal average (8,632). Sales-to-active listings ratioAcross all detached, attached and apartment property types, the sales-to-active listings ratio for January 2025 is 14.1 per cent. By property type, the ratio is 9.2 per cent for detached homes, 18.5 per cent for attached, and 16.5 per cent for apartments. Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months. “With new listings outpacing demand to start 2025, price trends saw little fluctuation in January across all segments, with the market overall standing in balanced conditions,” Lis said. “Our 2025 forecast calls for moderate price growth by the end of the year, but we have cautioned that shocks to the economy such as those currently threatening Canada via tariffs from the US could impact these estimates. "Going forward, whether these tariffs actually come into force, the duration they remain in place, and the degree to which Canada retaliates will determine the impact to the housing market in our region in the months ahead, if any.” MLS® HPIThe MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,173,000. This represents a 0.5 per cent increase over January 2024 and a 0.1 per cent increase compared to December 2024. Sales of detached homes in January 2025 reached 380, a 0.3 per cent increase from the 379 detached sales recorded in January 2024. The benchmark price for a detached home is $2,005,400. This represents a 3.1 per cent increase from January 2024 and a 0.4 per cent increase compared to December 2024. Sales of apartment homes reached 846 in January 2025, a 13.4 per cent increase compared to the 746 sales in January 2024. The benchmark price of an apartment home is $748,100. This represents a 1.7 per cent decrease from January 2024 and a 0.2 per cent decrease compared to December 2024. Attached home sales in January 2025 totalled 321, a 12.6 per cent increase compared to the 285 sales in January 2024. The benchmark price of a townhouse is $1,105,600. This represents a 2.7 per cent increase from January 2024 and a 0.8 per cent decrease compared to December 2024. Download the January 2025 Housing Report * Areas covered by Greater Vancouver REALTORS® include: Bowen Island, Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler.

Posted on

January 21, 2025

by

Marie Taverna

That was quick! Welcome to Nature’s Walk in South Meadows. Lovely 3 bedroom and 2.5 baths turn-key townhome is perfect for a family or singles that want some space. The kitchen is equipped with high end appliances, including a gas range, stone counter tops and lots of cabinets for storage. Dining room & living room with electric fireplace flow together for entertaining. Powder room on main level. Easy care laminate & tile flooring. Forced air heat, air-conditioning plus water on demand. Primary bedroom has a vaulted ceiling with walk through closet to 4-piece ensuite. Two other bedrooms. 4-piece main bath. Stackable laundry up. Double tandem garage. Front fenced yard with artificial turf. Enjoy the fabulous Meadows Club with pool, jot tub, gym, children’s play area, games room, golf simulator and much more. Make a first date to view this beauty.

Posted on

January 21, 2025

by

Marie Taverna

Welcome to 940 Spence Avenue in West Coquitlam. Fabulous family home in a quiet neighbourhood. 4 bedroom, 2 bath home is perfect for a growing family. Warm & inviting living room with gas fireplace. Large family kitchen with lovely wood cabinets, lots of counter space & stainless-steel appliances. Large, covered sundeck for those summer parties.3 good size bedrooms up.The basement is awaiting your decorating ideas. Mostly fenced large backyard for the kids and Fido.Shed for garden storage. Back lane for future possibilities. Check with Coquitlam City Hall for future possible plans. Large garage for 1 car or 2 Fiat 500s tandem. Flat driveway for cars or more. Stroll to Miller Park, schools & transit. Make a date to view this home. Offered for sale at $1,850,000

Posted on

January 21, 2025

by

Marie Taverna

The “TERRACES." CUTE 1 bed & den unit, perfect for a 1st time buyer or empty nester wanting to downsize,or anyone in between.From the moment you walk in you will love the nature light streaming in.Large living room with wood burning fireplace.Sliders to balcony facing south&enjoy view to Metro Town.Cozy kitchen with stain glass window.Dining room with retro light fixture.Good size primary bedroom with walk through closet to 4-piece bath. Bonus,den/office/guest bedroom/shoe closet, you decide!Laundry closet, just add washer&dryer.Also a shared laundry room in the building.Easy care flooring.1 parking spot.1 Locker on the same floor as unit. Transit, shopping & recreation close by. Great for students commuting to SFU or BCIT. Book a first date to view this condo. Listed for sale at $524,900.00

Posted on

January 9, 2025

by

Marie Taverna

SURREY, BC – Bank of Canada interest rate cuts that began mid-year were not enough to ease the affordability crisis for many home buyers in the Fraser Valley in 2024, leading to a decline in annual sales.The Fraser Valley Real Estate Board reported new listings of 35,698 for the year ended December 31, 2024, a 10-year high and nine per cent above the 10-year average. However, annual sales recorded on the Multiple Listing Service® (MLS®) were the lowest seen in ten years at 14,570, a decline of one per cent over 2023 and 24 per cent below the 10-year average. The City of Surrey accounted for the majority of 2024 sales at 51 per cent, with Langley and Abbotsford accounting for 24 per cent and 15 per cent respectively. “2024 marked another subdued year for Fraser Valley home sales on the heels of a ten-year low in 2023,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “Slight declines in home prices across some areas of the region provided negligible relief for buyers looking to get into the market. At the same time, the modest price adjustments did not discourage sellers from listing.” The composite Benchmark home price in the Fraser Valley closed the year at $965,000, down two per cent year-over-year, and down four per cent from its 2024 peak in March. December 2024 The Board recorded 994 sales on its MLS® in December, a decline of 13 per cent from November, but 19 per cent above sales from December 2023. New listings declined 46 per cent from November to December, from 2,367 to 1,288, contributing to a 23 per cent decline in overall inventory in December. With a sales-to-active listings ratio of 16 per cent in December, the overall market closed out the year in balance. The market is considered balanced when the ratio is between 12 per cent and 20 per cent. “While the Fraser Valley saw overall balanced market conditions for most of 2024, the low levels of buying and selling activity reflected a challenging year for many as would-be buyers waited for affordability to improve,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Interest rate cuts by the Bank of Canada along with recent government policies aimed at boosting overall housing supply and improving affordability, should help to increase market conditions in 2025.” It took longer to sell townhomes and condos in December compared to November. Townhomes spent 36 days on the market, up from 33 days in November, while condos spent 38 days on the market, up from 36 days in the previous month. Single-family homes spent 43 days on the market — no change from November. The composite Benchmark home price in the Fraser Valley continued to slide for the ninth straight month, down 0.5 per cent compared to November. To read the full statistics package, click here.

Posted on

January 9, 2025

by

Marie Taverna

Home sales registered on the Multiple Listing Service® (MLS®) in Metro Vancouver rose over thirty per cent in December, compared to the previous year, signalling strengthening demand-side momentum to close out 2024.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 26,561 in 2024, a 1.2 per cent increase from the 26,249 sales recorded in 2023, and a 9.2 per cent decrease from the 29,261 sales in 2022.

Last year’s sales total was 20.9 per cent below the 10-year annual sales average (33,559).

“Looking back on 2024, it could best be described as a pivot year for the market after experiencing such dramatic increases in mortgage rates in the preceding years,” said Andrew Lis, GVR’s director of economics and data analytics. “With borrowing costs now firmly on the decline, buyers have started to show up in numbers after somewhat of a hiatus – and this renewed strength is now clearly visible in the more recent monthly data.”

Properties listed on the MLS® system in Metro Vancouver totalled 60,388 in 2024. This represents an 18.7 per cent increase compared to the 50,894 properties listed in 2023. This was 9.7 per cent above the 55,047 properties listed in 2022.

The total number of properties listed last year was 5.7 per cent above the region’s 10-year annual average (57,136).

Currently, the total number of homes listed for sale on the MLS® system in Metro Vancouver is 10,948, a 24.4 per cent increase compared to December 2024 (8,802). This total is also 25.3 per cent above the 10-year seasonal average (8,737).

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,171,500. This represents a 0.5 per cent increase over December 2023 and a 0.1 per cent decrease compared to November 2024.

“Disappointingly, sales came in shy of our forecasted target for the year, but the December figures signal an emerging pattern of strength in home sales, building on the momentum seen in previous months,” Lis said. “These more recent sales figures are now trending back towards long-term historical averages, which suggests there may still be quite a bit of potential upside for sales as we head into 2025, should the recent strength continue.

“Although sales activity had a slower start to the year, price trends began 2024 on the rise and closed out the year on a flatter trajectory. Most market segments saw year-over-year increases of a few per cent except for apartment units, which ended 2024 roughly flat. With the data showing renewed strength to finish the year however, it looks as though the 2025 market is positioned to be considerably more active than we’ve seen in recent years.”

| December 2024 summary | Residential sales in the region totalled 1,765 in December 2024, a 31.2 per cent increase from the 1,345 sales recorded in December 2023. This was 14.9 per cent below the 10-year seasonal average (2,074) for the month.

There were 1,676 detached, attached and apartment properties newly listed for sale on the MLS® system in Metro Vancouver in December 2024. This represents a 26.3 per cent increase compared to the 1,327 properties listed in December 2023. This was 1.1 per cent below the 10-year seasonal average (1,695).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for December 2024 is 16.8 per cent. By property type, the ratio is 12.1 per cent for detached homes, 23.6 per cent for attached, and 18.7 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

Sales of detached homes in December 2024 reached 494, a 31.4 per cent increase from the 376 detached sales recorded in December 2023. The benchmark price for a detached home is $1,997,000. This represents a two per cent increase from December 2023 and is nearly unchanged compared to November 2024.

Sales of apartment homes reached 891 in December 2024, a 23.9 per cent increase compared to the 719 sales in December 2023. The benchmark price of an apartment home is $749,900. This represents a 0.1 per cent decrease from December 2023 and a 0.4 per cent decrease compared to November 2024.

Attached home sales in December 2024 totalled 371, a 55.9 per cent increase compared to the 238 sales in December 2023. The benchmark price of a townhouse is $1,114,600. This represents a 3.4 per cent increase from December 2023 and a 0.3 per cent decrease compared to November 2024.

| | Download the 2024 year-end stats package |

Posted on

January 9, 2025

by

Marie Taverna

Listed for $899,900.00 Welcome to Nature’s Walk in South Meadows. Lovely 3 bedroom and 2.5 baths turn-key townhome is perfect for a family or singles that want some space. The kitchen is equipped with high end appliances, including a gas range, stone counter tops and lots of cabinets for storage. Dining room & living room with electric fireplace flow together for entertaining. Powder room on main level. Easy care laminate & tile flooring. Forced air heat, air-conditioning plus water on demand. Primary bedroom has a vaulted ceiling with walk through closet to 4-piece ensuite. Two other bedrooms. 4-piece main bath. Stackable laundry up. Double tandem garage. Front fenced yard with artificial turf. Enjoy the fabulous Meadows Club with pool, jot tub, gym, children’s play area, games room, golf simulator and much more. Make a first date to view this beauty.

Posted on

December 17, 2024

by

Marie Taverna

Welcome to Edgewood Manor.What a fabulous opportunity to move into this condo unit. Ground level home has 2bedrooms & 2 full four-piece baths. Large windows let the natural light in.Extra large outdoor patio, imagine entertaining when the warmer weather arrives.The living room has a gas fireplace with sliders to your patio. Dining room is perfect for family dinners.Large kitchen with eating area. The primary bedroom has sliders to patio as well. 2 closets in the walkway to the ensuite. In suite laundry. In suite storage/pantry could be re-design for a cute home office. Two underground side by side parking spots and storage locker for your seasonal items. Priced more than $70,000 under BC Assessment. Book a first date to view this ground level condo.

Posted on

December 17, 2024

by

Marie Taverna

Canada’s housing market continued its upward trend in November 2024, as it recorded gains in both sales activity and prices, according to the latest report from the Canadian Real Estate Association (CREA). This marks the sixth consecutive month of sales growth, further solidifying the market’s recovery since mid-year when the first cut to the overnight lending rate was made. Key urban centers such as the Greater Toronto Area, Greater Vancouver, Calgary, and Montreal all saw increased activity, with notable gains also recorded in several smaller cities across Alberta and Ontario. Sales growth persistsHome sales in November 2024 increased by 2.8% compared to October. Since May 2024 – just before the first interest rate cut in June – sales have risen by a cumulative 18.4%. This sustained growth reflects stronger buyer demand across the country. “Not only were sales up again, but with market conditions now starting to tighten up, November also saw prices move materially higher at the national level for the first time in almost a year and a half,” said Shaun Cathcart, CREA’s Senior Economist. “Normally we might expect this market rebound to take a pause before resuming in the spring; however, the Bank of Canada’s latest 50-basis point cut together with a loosening of mortgage rules could mean a more active winter market than normal.” Home prices show largest monthly increase since JulyThe National Composite MLS® Home Price Index (HPI) rose 0.6% from October to November, marking the largest month-over-month increase since July 2024. While prices had been relatively stable for much of the year, the November increase suggests renewed upward pressure on home values. The non-seasonally adjusted National Composite MLS® HPI stood 1.2% below November 2023, the smallest decline since last April.

Meanwhile, the actual – not seasonally adjusted – national average home price for November 2024 was $694,411, up 7.4% from November 2023. Fewer listings availableThe total number of homes for sale declined in November. There were a little more than 160,000 properties listed on Canadian MLS® Systems at the end of the month, representing an 8.9% increase from the same period last year. However, this total remains below the long-term average of 178,000 listings for this time of year. National inventory levels continued to shrink last month, making conditions more competitive for buyers. There were 3.7 months of inventory on a national basis at the end of November, down from 3.8 months in October. This marks the lowest inventory level in 14 months.

Posted on

December 17, 2024

by

Marie Taverna

This marks the second consecutive 50-basis-point cut to the overnight rate this yearIn its last announcement of the year, the Bank of Canada made another supersized cut to its key lending rate. In its scheduled December 2024 release, the central bank announced that it had lowered the target for the overnight lending rate by 50 basis points to reach 3.25%. This marks the fifth consecutive cut to rates in 2024, and the second consecutive 50-basis-point cut. In October, Canada’s Consumer Price Index (CPI) increased 2.0% on a year-over-year basis, up from a 1.6% increase in September. Despite this increase, current levels continue to meet the Bank’s 2% inflation target. Weaker-than-expected GDP growth, in addition to reduced immigration levels and the possibility of new trade tariffs with the United States, justified the Bank’s decision to lower rates again in order to stimulate the economy while keeping inflation under control. “With inflation back to target, we have cut the policy rate by 50 basis points at each of the last two decisions because monetary policy no longer needs to be clearly in restrictive territory. We want to see growth pick up to absorb the unused capacity in the economy and keep inflation close to 2%,” said Tiff Macklem, Governor of the Bank of Canada, in a press conference with reporters following the announcement. “The Governing Council has reduced the policy rate substantially since June, and those cuts will be working their way through the economy. Going forward, we will be evaluating the need for further reductions in the policy rate one decision at a time.”

Another rate cut increases likelihood of early spring marketWith lower borrowing rates comes the likelihood of more robust activity throughout the winter months and an earlier-than-normal spring market, leading to upward pressure on home prices. According to the Royal LePage 2025 Market Survey Forecast, the aggregate1 price of a home in Canada is set to increase 6.0% year over year to $856,692 in the fourth quarter of 2025, with the median price of a single-family detached property and condominium projected to increase 7.0% and 3.5% to $900,833 and $605,993, respectively.2 Sidelined buyers are being encouraged back to the market following several rate cuts by the central bank and the optimism of more to come. Coupled with the implementation of new mortgage policies — including the increased insurance cap and 30-year amortizations for first-time buyers and pre-construction buyers — lower rates are expected to spur activity heading into the spring. “Starting in late spring 2024, we have seen the Bank of Canada continue to lower the cost of borrowing, a process that has prompted homebuyer demand to steadily rise, with a sharp uptick in activity following their first 50-point cut in October. This latest significant rate cut will help to sustain activity throughout the winter months, typically the slowest period for real estate transactions in Canada,” said Phil Soper, president and CEO of Royal LePage. “Buyers have woken up to the reality that property prices are rising again, and more will feel an urgency to act before affordability erodes. As a result, we are anticipating a ‘pull-ahead’ of activity and an early start to the traditional spring housing market. Adding to this momentum is the change in lending policies that come into effect on December 15th, which we believe will coax more sidelined purchasers to take advantage of their expanded borrowing power.” Many sidelined homebuyers have been waiting for rates to drop significantly before reentering the market. With another cut now in the books, many will feel that interest rates have dropped enough for them to revisit their home purchase plans. According to a Royal LePage survey, conducted by Leger, 51% of Canadians who put their home buying plans on hold the last two years said they would return to the market when the Bank of Canada reduced its key lending rate. Eighteen percent said they would wait for a cut of 50 to 100 basis points, and 23% said they’d need to see a cut of more than 100 basis points before considering resuming their search. The Bank of Canada will make its next interest rate announcement on Wednesday, January 29th, 2025. Read the full December 11th report here.

Posted on

December 9, 2024

by

Marie Taverna

With two consecutive months of sales increases punching up approximately 30 per cent year-over-year in October and now November, we may be entering the phase of the cutting cycle where the impacts to sales begin being more easily recognizable in the data. Learn more in our latest The Lede, blog post, from GVR economist Andrew Lis: https://economics.gvrealtors.ca/.../2024-12-04-We-Have... #GVR #economics #vancouverrealestate

Posted on

December 5, 2024

by

Marie Taverna

The crisp fall air signals to us that winter is on its way, and with that, the familiar cozy nights, twinkling lights, and joy of decorating for the holiday season. For many, this time of year is a cherished opportunity to transform their homes into a winter wonderland. Whether you love the nostalgia of decking the halls with traditional red-and-green ornaments and tinsel, or prefer a more modern take on festive décor, it seems all options are on the table this holiday season. Here are the top four 2024 holiday décor trends to spark inspiration for your celebrations: 1. Muted luxeThis year, the classic holiday palette of red, green, and gold is replaced by softer tones, such as sage green, champagne, dusty rose, and icy blue. These muted hues, paired with metallic accents like brushed gold or antique silver, create a more refined and calming look for your home. Think velvet stockings, metallic-dusted wreaths and pale ornaments to bring an elevated vibe to your space. To add contrast, consider incorporating darker tones such as deep navy or charcoal. This trend offers an effortlessly elegant way to make your space festive without feeling overly bold. 2. Vintage nostalgiaDoes merrily muted sound mundane to you? Then this might be the style you’re looking for. Vintage-inspired décor is back in a big way. Crystal and glass ornaments, retro tinsel garlands, ceramic Christmas trees and vintage menorahs provoke a sense of nostalgia that warms the heart and the home. You can find authentic heirloom pieces by exploring thrift shops, flea markets, or asking older family members for cherished treasures. For those who love the look but prefer something new, many retailers acknowledge that traditional holiday style is back in full swing, and now offer vintage-inspired holiday décor. Pair these pieces with candles or warm string lights to create a timeless, cozy atmosphere that makes any house feel like home. 3. Natural eleganceAs sustainability takes centre stage in many facets of our lives, nature-inspired holiday décor is no exception. Evergreen garlands adorned with dried orange slices, cinnamon sticks, and pinecones create a rustic and festive look – and they smell great, too! When decorating the tree, consider swapping out plastic bobbles for dried fruits, a popcorn garland or ornaments made of natural materials, like wood or paper. Continue this theme throughout the home by dressing up your dining table with linen napkins, fresh greenery, and seasonal fruit displayed as the centrepiece. This trend is perfect for those who want their eco-conscious lifestyle to be reflected in their holiday decorations. 4. Textured layersStyling the home with layered textures continues from fall into winter, creating comfy and cozy holiday vibes. Blend soft, chunky knits with plush velvets, faux furs, and natural materials like woven cotton or linen. This approach adds depth and dimension to any room, making your home feel as inviting as your favourite holiday sweater – but don’t stop there! Take texture to another level by adding ribbon, felt ornaments, or macramé to your home. For your tablescape, mix and match materials by pairing a cotton tablecloth with rattan placemats, or layering linens with soft runners in contrasting patterns. Add natural elements like greenery, flowers, or seasonal foliage. In living spaces such as the sitting room or bedroom, drape blankets and throw pillows in seasonal hues and incorporate textures like glass, wood, and metal to create a cozy and inviting environment throughout your home. Bonus tip: Extend the cheer outdoorsYour outdoor holiday décor doesn’t have to stop at stringing lights along the rooftop! Add twinkle-lights, lanterns, and weather-resistant greenery along banisters and around door and window frames to bring the spirit of the holiday season to the outdoors. A welcoming porch or patio can make your home feel festive inside and out. This holiday season, embrace the opportunity to create traditions and have your home reflect your personal style. Whether you prefer the understated elegance of muted tones, the timeless charm of vintage décor, or the natural beauty of sustainable elements, there’s a trend to suit every taste. With a little creativity, your home can shine as a joyful centerpiece for the season, ready to make lasting memories. ContributorMichelle McNallyCommunications manager, Royal LePage Michelle is a member of Royal LePage’s Communications and Public Relations team, and works to deliver unique and insightful Canadian real estate content to media and consumers. Prior to joining Royal LePage, Michelle was an online reporter specializing in Canadian real estate and pre-construction development. She is a graduate of Toronto Metropolitan University’s esteemed journalism program.

|

Subscribe with RSS Reader

Subscribe with RSS Reader