Posted on

February 23, 2023

by

Marie Taverna

The first resale policy of its kind in Canada, homes bought and sold in British Columbia will now be automatically enrolled in a mandatory multi-day rescission period, according to new legislation.

The Homebuyer Protection Period took effect in British Columbia on January 3rd, 2023. Also known as the Homebuyer Recission Period (HBRP) or cooling-off period, the new policy requires a three-business-day interval after a purchase offer is accepted on a home, allowing purchasers to rescind their contract if they choose to.

Although similar laws exist abroad in countries such as France and New Zealand, B.C. is the first province in the country to implement a protection period for resale and new construction homes, according to the provincial government.

Here’s a roundup of everything you need to know about the B.C. Homebuyer Protection Period:

What is the purpose of the cooling-off period?

By allowing up to three business days for a buyer to retract their offer, the protection period gives purchasers more time to consider whether buying a property is right for them, especially in a high-pressure sales environment. The three-day wait also gives buyers time to complete due diligence as part of the transaction, such as securing financing or arranging a home inspection.

According to the BC Financial Service Authority (BCFSA), the protection period applies to all residential real property transactions, regardless of whether a real estate professional is involved in the purchase or not. The protection period cannot be waived by the buyer or the seller.

How does the policy work?

The protection period takes effect the next full business day after an offer is accepted. For example, if an agreement is accepted on Monday afternoon, the rescission period would expire on Thursday at 11:59 p.m. If the purchase agreement contains conditions such as a home inspection, these clauses will run concurrently with the rescission period.

Only a few exemptions apply under the protection period, such as properties that are located on leased land, under a court order or sold at auction.

Real estate professionals are required to provide disclosures on HBRP regulations, which include information about rescission rights, exemptions and a calculation of the amount that the buyer must pay to the seller in the event of rescission.

What happens if a buyer rescinds their offer?

Should the buyer choose to cancel their contract during the cooling-off period, they are required to pay 0.25% of the purchase price, or $250 for every $100,000, to the seller. On a $1 million home, this would equal $2,500.

The fee to the seller is paid out of the deposit the buyer provides upon acceptance of the offer, and the remainder is refunded to the purchaser. In cases where a deposit is not provided with the agreement, payment can be provided directly to the seller or through the buyer’s representative to give to the seller or their agent. The buyer must notify the seller in writing that they are retracting the offer.

For more information on British Columbia’s Homebuyer Protection Period, visit the provincial government’s website or review BCFSA’s HBRP consumer guide.

Posted on

February 23, 2023

by

Marie Taverna

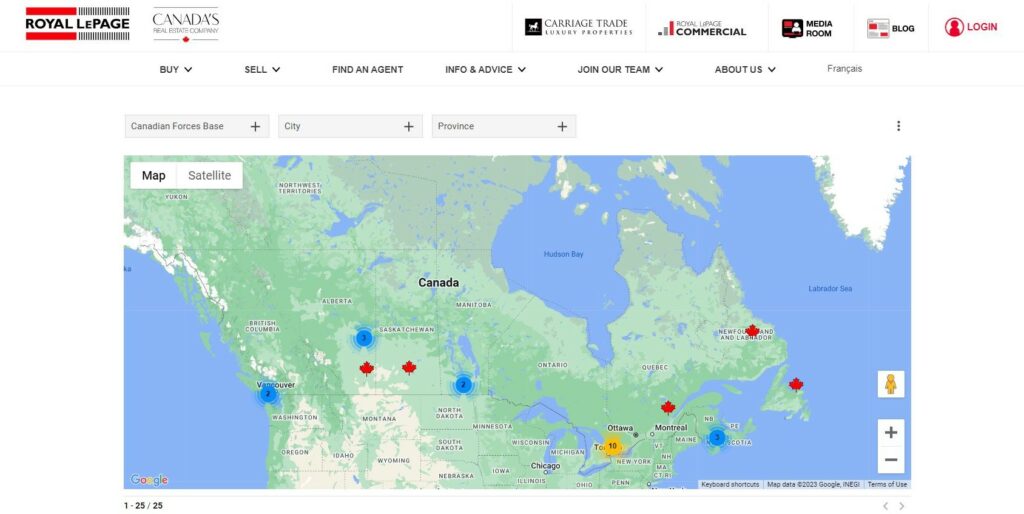

Many military members and their families find themselves moving between bases across Canada during their years of service. Between house hunting, offer negotiation and packing, moving to a new home is taxing enough without the additional stressors those working in the Canadian military can face during relocation. To better serve our military members, Royal LePage offers a network of relocation experts who are available from coast to coast to make the moving process as smooth as possible.

Whether you’re being transferred or moving onto a military base for the first time, Royal LePage has agents across the country who are there to help. Royal LePage’s community of REALTORS® are available to support military members with their various real estate needs, including providing up-to-date information on the market, finding homes that fit a specific criteria, or connecting buyers to other real estate experts across the nation.

The Canadian Forces Base map on royalepage.ca shows users the location of Royal LePage brokerages available within close proximity to base locations. Users can simply browse through the map and click on the red maple leaf markers to bring up a list of local Royal LePage offices in their desired location.

Are you or someone you know looking for assistance with military relocation? Visit our website for more information on our services and to connect with a member of our network.

Posted on

February 23, 2023

by

Marie Taverna

Despite several consecutive hikes in interest rates over the past year, home prices in Canada have remained relatively stable thanks to low inventory. In major housing markets across the country, a $1-million price tag is not uncommon, but the type of property available at this price point can vary from one city to another.

In examining what a budget of approximately $1 million – give or take $50,000 – can buy in Canada’s major housing markets, Royal LePage determined that the average home in Canada valued between $950,000 and $1,050,000 in December of 2022 had 3.2 bedrooms, 2.6 bathrooms and 1,763 square feet of living space, inclusive of all property types. Data for the report was provided by Royal LePage’s sister company RPS Real Property Solutions, a leading Canadian real estate valuation company.

“The mythical million dollar house may not be the mansion it once was, yet a million-dollar budget will still buy a luxurious home in many parts of Canada,” said Phil Soper, president and CEO of Royal LePage. “For those who live in our most expensive cities, low seven figures will get you a lovely, if more modest home.”

In today’s post-pandemic landscape, more Canadians than ever before have the option to work fully remotely, resulting in the ability to choose the city or town where they want to live without being restricted by the local job market.

“Wider acceptance of fully remote employees has given more Canadian homebuyers the flexibility to live and work wherever they like. For those who prioritize square footage, outdoor space and luxurious features, $1 million will go a lot further in cities outside of Toronto and Vancouver,” noted Soper.

Here are a few highlights from the Royal LePage Million-Dollar Properties Report:

- Nationally, a typical $1-million home boasts an average of 3.2 bedrooms, 2.6 baths and almost 1,800 square feet of living space.

- Remote work has given homebuyers greater flexibility to choose where they want to live, including more affordable cities where a million-dollar budget may stretch farther.

- $1-million homes in the Greater Toronto Area and Greater Vancouver offer less square footage and fewer bedrooms and bathrooms than the national average.

- Unlike Canada’s two other largest metropolitan centres, the Greater Montreal Area boasts an average home size that is 523 square feet larger than the national average.

- Halifax, Edmonton and Winnipeg boast the largest average square footage of all major cities in Canada at this price point.

Posted on

February 15, 2023

by

Marie Taverna

February 14th is just around the corner! While Valentine’s Day is a great excuse to visit our local restaurants, flower shops and chocolatiers, it’s also the perfect opportunity to make a donation that supports healthy love!

|

|

|

|

|

|

|

Please honour your sweetheart, children, friends, or even yourself by donating $14 this February 14th. 100% of your gift will fund programs that teach young people in Canada how to build and nurture relationships with romantic partners and friends that are defined by these feelings, actions and behaviours:

-

A comfortable pace

-

Trust

-

Honesty

-

Independence

-

Fun

-

Respect

-

Taking responsibility

-

Equality

-

Kindness

-

Healthy conflict

After donating, you’ll gain access to a ‘healthy love’ graphic and content you can share on social media to start a conversation about what defines a healthy relationship. We encourage you to spread the word and encourage your followers to join you in this important work. Together, we can prevent younger generations from experiencing and perpetrating domestic violence.

Happy Valentine’s Day!

|

Posted on

February 6, 2023

by

Marie Taverna

Lagging Inventory Builds Demand as Bank of Canada Signals Hold on Interest Rates

REBGV Market Activity – January 2023

The current housing market in Greater Vancouver presents a timely opportunity for astute buyers. As interest rates have risen over the past year, the average home price has experienced downward pressure, leading to a decrease in the average cost of housing and the potential to build equity in the longer term for those willing to take advantage of this market correction. As interest rates settle in 2023, property values are expected to consolidate and begin to increase in the latter half of the year, resulting in positive equity growth for early buyers.

“Due to seasonality, market activity is quieter in January. With mortgage rates having risen so rapidly over the last year, we anticipated sales this month would be among the lowest in recent history,” said Andrew Lis, REBGV’s director, economics and data analytics. “Looking forward, however, the Bank of Canada has said that it will pause further rate increases as long as the incoming economic data continues to support this policy stance. This should provide more certainty for home buyers and sellers in the market.”

Detached housing in Greater Vancouver has experienced the largest decrease in value, with an average price of $1,909,101 in January, a 17% drop from its peak in February 2022 of $2,306,603. On the other hand, the condo market has remained relatively stable, with an average sales price of $758,855 in January, a 12% decrease from the all-time high in February

2022 of $846,610.

Inventory and New Listings Off to a Slow Start

Total inventory across all asset classes in January was 7,389 active listings, a 19% year-over-year increase. The condo market saw the most new listings with 1,699, while the detached market had the lowest January total in recent history with only 1,035 new listings.

The lack of new inventory is creating increased competition for desirable homes, particularly in the low-rise category. Buyers who held off last year on making a move are now competing for quality homes, and in some cases finding themselves in multiple offer scenarios given the insufficient number of listings on the market. Sellers looking to list their home in the remaining winter months may be pleasantly surprised by the attention a well maintained, well priced home will receive in this current market.

Bank of Canada Announcement Provides Assurances to Consumers

On January 25th, in light of higher than anticipated employment numbers in December 2022, The Bank of Canada raised its benchmark interest rate by 25 basis points, to 4.5%. While this was the Bank’s eighth consecutive interest rate increase, the announcement was primarily significant due to the Bank’s inclusion of forward guidance that it expects to hold off on future rate hikes. Economists are already predicting that the Bank of Canada will turn its focus to easing monetary policy by the end of this year. This shift allows consumers to once again rely on mortgage interest rates remaining steady and with that, renews confidence that real estate will not see the declines in value in 2023 that we saw in 2022.

Opportunity Knocks

A contrarian mindset has been beneficial for past purchasers who chose to buy during the market corrections in 2019 and 2009. While the Covid-driven anomalistic growth trend which saw values increase 42% between June 2020 and February 2022 may be behind us, savvy buyers are keen to pick up properties off the peak with less competition than the recent years afforded.

“We know the peak for prices in our market occurred last spring. Over the coming months, year-over-year data comparisons will show larger price declines than we’ve been reporting up to now,” said Lis. “It’s important to understand that year-over-year calculations are backward-looking. These price declines already happened, and what we are seeing today is that prices may have found a footing, even if it’s an awkward one sandwiched between low inventory and higher borrowing costs.”

Posted on

February 2, 2023

by

Marie Taverna

When renovating a home, the major concerns are often making the space more functional, stylish, and cozy. But when you have a pet, or are planning to get one, some of those design considerations may change to best suit your four-legged family member’s needs.

Here are a few tips to help make your home more pet-friendly:

Avoid carpet flooring

Carpets can gather dirt and stains like no other. Many pets shed, and some may feel the occasional need to relieve themselves in the wrong place. Plus, animals can easily tip over glasses and plates with their tails while exploring tabletops. Avoid a time-consuming and potentially expensive clean-up, and opt for durable and easy-to-clean flooring like laminate, vinyl, stone, or ceramic.

Get washable, wipeable furnishings

When it comes to your couch and other furniture, choose fabrics and textures that are less of a magnet for pet fur and, if necessary, are somewhat claw-resistant. Consider certain types of synthetic fibres that can be more resistant to damage. You may also want to apply a protective layer of wipeable paint… just in case you end up with paw prints on your walls.

Design a ‘pet pad’

As a way to minimize mess and not give the impression that you have a Tasmanian devil for a pet, consider setting up a designated play area for your furry friend. Retrofit a small portion of your home with a comfy bed, bowls for food and water, a storage bin for toys, and scratch pads. If they feel like they have their own space, it may keep your pets from spreading toys around the house and taking things from other rooms. This can also help contain any potential messes to one area of your home… preferably one that has durable floors.

Safety-proof your yard

Outside of the home, plant only pet-friendly flowers and plants in your garden, avoiding toxic vegetation like tulips, lilies and certain kinds of mulch. Provide your pet with an outdoor shelter and some shade for hot summer days. Ensure you build a sturdy fence around the yard to help keep them from running away. This should also prevent skunks, raccoons and other critters – including your neighbours’ pets – from setting up shop on your property and harming or disturbing your furry friend.

Posted on

February 2, 2023

by

Marie Taverna

Classic European inspired 5 bedroom, 4 bath executive home located in the prestigious “The Uplands” neighbourhood in Anmore. Experience stunning mountain views in a private rural lot, just a short drive for the city. Perfect for entertaining, with a dream kitchen complete with solid wood cabinets, SS appliances, granite countertops & expansive kitchen island. Family room French doors open to massive outdoor deck, complete with 2 gas hookups. Rest easy in the large primary bedroom complete with gas fireplace, walk in closet, shower & soaker tub. Property boosts in ground sprinklers, aircon, custom blinds & beautiful wooden floors. Walkout basement has suite potential with private balcony, 2 bedrooms, & rec room. Don’t miss out on this perfect balance of natural & elegance.

http://share.jumptools.com/studioSlideshow.do?collateralId=230354&t=2918&b=1

Posted on

February 2, 2023

by

Marie Taverna

Fraser Valley real estate sales record slowest annual start in ten years; January new listings lowest in over thirty years

Posted on

February 2, 2023

by

Marie Taverna

Home sales decline below long-term averages and inventory remains low to start 2023

Inventory remains low in Metro Vancouver while home sales dipped well below monthly historical averages in January.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,022 in January 2023, a 55.3 per cent decrease from the 2,285 sales recorded in January 2022, and a 21.1 per cent decrease from the 1,295 homes sold in December 2022.

Last month’s sales were 42.9 per cent below the 10-year January sales average.

“Due to seasonality, market activity is quieter in January. With mortgage rates having risen so rapidly over the last year, we anticipated sales this month would be among the lowest in recent history,” said Andrew Lis, REBGV’s director, economics and data analytics. “Looking forward, however, the Bank of Canada has said that it will pause further rate increases as long as the incoming economic data continues to support this policy stance. This should provide more certainty for home buyers and sellers in the market.”

There were 3,297 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in January 2023. This represents a 20.9 per cent decrease compared to the 4,170 homes listed in January 2022 and a 173.4 per cent increase compared to December 2022 when 1,206 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 7,478, a 32.1 per cent increase compared to January 2022 (5,663) and a 1.3 per cent increase compared to December 2022 (7,384).

For all property types, the sales-to-active listings ratio for January 2023 is 13.7 per cent. By property type, the ratio is 10.2 per cent for detached homes, 13.4 per cent for townhomes, and 16.7 per cent for apartments.

Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“We know the peak for prices in our market occurred last spring. Over the coming months, year-over-year data comparisons will show larger price declines than we’ve been reporting up to now,” said Lis. “It’s important to understand that year-over-year calculations are backward-looking. These price declines already happened, and what we are seeing today is that prices may have found a footing, even if it’s an awkward one sandwiched between low inventory and higher borrowing costs.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,111,400. This represents a 6.6 per cent decrease over January 2022 and a 0.3 per cent decrease compared to December 2022.

Sales of detached homes in January 2023 reached 295, a 52.6 per cent decrease from the 622 detached sales recorded in January 2022. The benchmark price for a detached home is $1,801,300. This represents a 9.1 per cent decrease from January 2022 and a 1.2 per cent decrease compared to December 2022.

Sales of apartment homes reached 571 in January 2023, a 56.6 per cent decrease compared to the 1,315 sales in January 2022. The benchmark price of an apartment home is $720,700. This represents a 1.1 per cent decrease from January 2022 and a one per cent increase compared to December 2022.

Attached home sales in January 2023 totalled 156, a 55.2 per cent decrease compared to the 348 sales in January 2022. The benchmark price of an attached home is $1,020,400. This represents a three per cent decrease from January 2022 and a 0.8 per cent increase compared to December 2022.

Download the January 2023 stats package.

Posted on

January 31, 2023

by

Marie Taverna

|

Home sales in 2023 will remain in line with last year while prices may see small increases, according to the Real Estate Board of Greater Vancouver’s first 2023 Residential Market Forecast.

The forecast looks at current and historical market trends alongside economic factors like inflation and risk of recession to predict what 2023’s housing market will look like.

A second forecast will be coming in the second half of the year.

|

|

|

|

|

|

Key highlights

- The Bank of Canada is at, or very near, the peak of the current interest rate tightening cycle.

- Apartment sales are forecast to decrease over last year, while detached homes are forecast to increase.

- While increasing mortgage costs are decreasing purchasing power, other factors will continue to put upward pressure on prices.

|

| Read the report |

|

|

|

Posted on

January 24, 2023

by

Marie Taverna

Bank of Canada Interest Rate Announcement -

January 25, 2023

|

|

The Bank of Canada raised its overnight policy rate by 25 basis points to 4.5 per cent this morning. In the statement accompanying the decision, the Bank noted that recent economic growth in Canada as been stronger than expected and labour markets remain tight but it sees growing evidence that monetary policy is working to slow the economy. The Bank expects the economy to stall through the middle of 2023 before picking up later in the year. The Bank sees improvement in the inflation outlook with signs that core inflation has peaked and it projects a significant decline in inflation this year. It expects inflation to return to its 2 per cent target by 2024.

Most importantly, the Bank stated that it expects to hold its policy rate at 4.5 per cent as it monitors the impact of the last year of rate increases. While the door remains open to further rate increases should the outlook for inflation change, the Bank for now is on hold. From here, the trajectory of mortgage rates will depend on the outlook for the economy. With growth expected to slow in 2023, markets are pricing in Bank of Canada rate cuts by the end of this year and average five-year fixed mortgage rates have declined in January from their peak of 5.5 per cent to 5.19 per cent and will likely fall further in coming months. However, the average variable rate mortgage, now at 6.35 per cent will stay elevated until the Bank of Canada begins lowering its policy rate.

Link: https://mailchi.mp/bcrea/bank-of-canada-interest-rate-announcement-24s8ethx68 |

|

Posted on

December 31, 2022

by

Marie Taverna

$2,595,000 4100 plus square feet

CLASSIC EUROPEAN inspired EXECUTIVE 5 bdrm,4 bath home situated on prestigious Uplands Drive,on a gently sloping 1 acre lot offering privacy & a peaceful environment not far from city life bustle.With sweeping mountainside views, explore your PRIVATE FOREST low maintenance lot.ELEGANT LIVING &DINING rooms.Family room FRENCH doors lead to huge outdoor deck+back wooden deck for entertaining you will not know there are neighbors nearby.A DREAM Kitchen.LARGE PRINCPLE BDRM SUITE with gas fireplace,walkin closet,shower&soaker tub.Encompassing features like indoor&inground SPRINKLERS/AIRCON+HEAT PUMP/custom window blinds/elegant moldings/beautiful wooden floor.Walkout basement with private balcony 2 bdrms&rec room preplumbed/wired for kitchen/suite potential. Call your realtor to book a appt.

Posted on

December 31, 2022

by

Marie Taverna

If you’re working on a home improvement project – whether for you to enjoy, or in preparation to put your property on the market – you may be interested to know which renos will give you the most bang for your buck.

A kitchen renovation is the most worthwhile home improvement, and has the potential to increase the value of your property by 20%, according to a recent survey of Royal LePage experts.

“A kitchen is perceived as the gathering place and the heart of the home,” said Mike Heddle, broker and team leader, Royal LePage State Realty. “When a potential buyer views a home for the first time, the one thing that will stand out – for better or worse – is what the kitchen looked and felt like. They may not remember the size of the bedrooms or the colour of the walls, but they will remember the kitchen.”

Highlights from the national release:

- Royal LePage professionals say, on average, bathroom renovations can increase the value of a home by 16%

- Finished basements and basement apartments have the potential to increase a home’s value by 15%, according to survey results

- Outdoor entertaining space and landscaping have the potential to increase a property’s value by an average of 10%, according to respondents

- For Canadians looking for general guidance on where to invest in their home renovation projects, 87% of surveyed experts recommend interior renovations

For more insights, read the full press release and check out the data chart.

Posted on

December 31, 2022

by

Marie Taverna

While home prices in many real estate markets across Canada have recorded modest declines over the last few quarters, largely due to the rising cost of borrowing, the rate of decline has slowed. With the expectation that the Bank of Canada’s interest rate hike campaign is coming to a close, Royal LePage is forecasting that the national aggregate price of a home in the fourth quarter of 2023 will be $765,171, 1.0% below Q4 of 2022. Broken out by housing type, the median price of a single-family detached property and condominium are projected to decrease 2.0% and increase 1.0% to $781,256 and $568,933, respectively.

“After nearly two years of record price appreciation, fueled by a steep climb in household savings, very low borrowing costs and an overwhelming desire for more space during the COVID-19 pandemic, the frenzied housing market overshot and the inevitable downward slide or market correction began, intensified by rapidly rising borrowing rates,” said Phil Soper, president and CEO, Royal LePage. “In an era characterized by the unusual, this correction has not followed historical patterns. While the volume of homes trading hands has dropped steeply, home prices have held on, with relatively modest declines. We see this as a continuing trend.”

In the first quarter of 2023, the national aggregate home price is expected to decline on both a year-over-year and quarter-over-quarter basis, followed by near-flat quarterly price growth in Q2. In the second half of next year, the aggregate home price is expected to see modest quarterly gains, but will still remain lower than the same periods in 2022.

The recovery is not expected to be evenly distributed. Regional markets that saw more moderate price growth during the pandemic real estate boom are expected to experience more modest declines. Due to their relative affordability, cities like Calgary, Edmonton and Halifax are expected to record modest price gains in 2023, as they continue to attract out-of-province buyers, especially first-time homebuyers from southern Ontario and British Columbia looking for more affordable housing.

Read Royal LePage’s 2023 Market Survey Forecast for national and regional insights.

Highlights from the release:

- Condominium prices are expected to outdo single-family homes in all major markets across Canada, except Edmonton and Winnipeg

- The Greater Toronto Area and Greater Montreal are expected to see a Q4 2023 aggregate price decline of 2.0% year-over-year

- The Q4 2023 aggregate home price in Greater Vancouver is anticipated to decrease 1.0% year-over-year

- Despite declining affordability, heightened by rising interest rates, continued housing supply shortage acts as a floor on home price declines

Posted on

October 13, 2022

by

Marie Taverna

Basements are often an afterthought. Sometimes they’re dismissed as simply storage space – where your furnace and water heater are located, along with bins of clothes you’ll never wear again. If this is your mindset, you’re missing out on some great opportunities to reimagine this space.

See your basement with a fresh perspective. Here are a few ways that you can optimize your basement for a better living experience:

Personal gym

Forget paying for a membership. By investing in a few pieces of quality gym equipment, you can bring your workout home. It’s not always easy to stay motivated, but having easy access to your treadmill at home could be one less excuse to skip your run, especially on those cold days. And with a home gym, you can make exercise time a part of your family’s routine.

Playroom

If you have children, you know how quickly their toys can take over a room. By making the basement (or part of it) a dedicated play area, you can keep the clutter out of sight downstairs while giving the kids plenty of room for imaginative games and activities. Add a fresh coat of paint, a few whimsical decals and the toys of course, and you’ll have a playroom that dreams are made of.

Home theatre

With so many movies available on streaming platforms, trips to the cinema have become rare. But, you can recreate the experience at home with a large screen, projector, and theatre-style armchairs. For those with smaller basements, a quality flatscreen TV and a comfortable couch with lots of pillows can be just as enjoyable for family movie nights or entertaining friends.

Library

For all the book lovers out there, imagine having a special place to read, with all the paperbacks you’ve collected over the years at your fingertips. Whether it’s a few bookshelves and some comfy seating, or custom built-ins that showcase your collection in a creative way – a library is a wonderful addition to any home. Coordinating rugs, throws, and cushions can give this space a luxe yet cozy feel. It’s the perfect place to get lost in a good book!

Home office

Maybe the kitchen table isn’t cutting it. For some, working from home is now part of the regular routine but many still don’t have a dedicated home office. A well-designed workspace with an ergonomic desk and chair can not only increase your productivity and help motivate you to check off your daily to-dos faster, it can reduce the physical stress that your body endures during long stretches of sedentary activity. And the best part is, you don’t have to clear away your work day each time you sit down for a meal.

Basements are a blank canvas; extra square footage to play with and room to try something new. So, however you decide to use this part of your home, choose something you love and make the space your own!

Posted on

October 13, 2022

by

Marie Taverna

Fall is a beautiful time of year. As the leaves change colour, pumpkin patches open, and people enjoy spiced lattes and sweater weather, it’s only fitting to add a little fall flair to your home as well. And, seasonal décor doesn’t have to be difficult or break the bank.

Just in time for the Thanksgiving long weekend, here are some simple tips to warm up your home and a touch of autumn to your style:

Warm up your front entrance

Adorn the front of your home with fall-inspired welcome mats, wooden crates, and squash in various shapes and sizes. The beauty of fall is that there is no symmetry needed. Scatter different sized boxes, fall signs and a mix of small and large decorative pumpkins (real or fake). Hang a fall wreath made of twigs, and add a brown, orange or burgundy ribbon for a pop of colour.

Decorate your dining space

Beautify your home indoors with orange and earthy tones. Add a table runner, some coloured napkins on the table, and coordinating candles in the scents of the season. You can elevate your seasonal look with small squashes and gourds as centerpieces. And, don’t be afraid to bring the outside in… Design your own table arrangement with twigs, leaves and pine cones you collect.

Add a cookie and coffee station

Nothing says fall like warm beverages and treats while enjoying the crisp air! Impress your guests with a coffee and tea station. Set up cups, specialty teas displayed in a glass bottle, hot coffee and flavoured syrups in a section of your dining room or kitchen. Use risers or wooden trays to give the display some complexity. Add a cookie jar or cake stand with some fall goodies such as butter tarts, chocolate chip cookies, or brownies. You can also have a seasonal fruit basket with apples and pears.

Make it cozy

Celebrate fall with comfort by adding aromatic autumn candles… Think cinnamon, vanilla, pumpkin spice scents. Light them in the evenings for ambiance. Add fall-themed throw cushions, and add an earthy-toned warm blanket on your couch (check out Pinterest for inspiration on how to arrange pillows and blankets).

These simple tricks can elevate your home decor and make it feel as warm as your pumpkin or apple pie this season!

Posted on

October 13, 2022

by

Marie Taverna

Canadian home prices are projected to end the year modestly lower than where they were during the final months of 2021, undoing the price growth seen earlier this year. Royal LePage is forecasting that the aggregate price of a home in Canada will decrease 0.5% in the fourth quarter of 2022, compared to the same quarter last year, due to a continued softening of home prices in a majority of markets across the country in the third quarter (94% of regions in the report).

“September did not bring the typical seasonal lift in the number of homes trading hands in this country, a clear indication that our housing market continues to adjust to higher borrowing costs,” said Phil Soper, president and CEO of Royal LePage. “Home prices follow sales volume trends, which means we will see further softening in the final months of the year. Our revised outlook has national prices at just below where we ended 2021, erasing the gains made in the first quarter of 2022.”

According to the Royal LePage House Price Survey, the aggregate price of a home in Canada increased 3.3% year-over-year to $774,900 in the third quarter of 2022. However, on a quarterly basis, that figure decreased 4.9%; the second consecutive quarterly decline recorded. When broken out by housing type, the national median price of a single-family detached home rose 2.0% year-over-year to $806,100, while the median price of a condominium increased 6.1% year-over-year to $566,100.

With so many would-be buyers waiting on the sidelines, sales activity has weakened across the country.

“While sales volumes are well off the pandemic-fueled peak, many buyers remain active in today’s market. Some are motivated to transact before their locked-in mortgage pre-approval rates expire. Others are encouraged by a rare drop in home prices, the lack of bidding wars and the ability to include conditions in purchase offers,” added Soper. “At the first indication that interest rates have ended their climb and home prices have stabilized, I would expect a sharp increase in those entering the market as the need for housing has not diminished one bit. And regrettably, Canada continues to suffer from a severe shortage of housing supply.”

Read Royal LePage’s third quarter release for national and regional insights.

Third quarter press release highlights:

- National aggregate home price for the final quarter of the year forecast at -0.5%

- National aggregate home price increased 3.3% year-over-year in third quarter of 2022; decreased 4.9% quarter-over-quarter

- Prices remain well above pre-pandemic levels; Canada’s national aggregate home price increased 25.4% in Q3 over the same quarter in 2020, and 21.5% over the same quarter in 2019

- 58 of the report’s 62 regional markets posted quarterly aggregate home price declines in Q3

- Prices decline on a quarterly basis in Greater Montreal Area for the first time in more than five years as market activity drops, following trend set in greater regions of Toronto and Vancouver in Q2

- Major markets in Atlantic Canada and the Prairies show modest quarterly price declines in Q3; Calgary and Edmonton markets faring better than other major cities

Posted on

September 21, 2022

by

Marie & Kim Taverna

Royal LePage Survey: 3.2 million boomers in Canada considering buying a home within the next five years

Survey Highlights:

According to a recent Royal LePage survey[1] of boomers in Canada, defined by StatsCan as having been born between 1946 and 1965, 35 per cent of the cohort – or approximately 3.2 million boomers[2] – said they are considering a home purchase within the next five years. Nationally, 45 per cent of respondents believe now is a good time to sell their home.

“The boomer generation appears to have no intention of slowing down,” said Phil Soper, President and CEO, Royal LePage. “Fully vaccinated, and turning a cold shoulder to retirement, the typical member of this huge demographic is enjoying an empty nest and believes real estate is a good investment. Millions of boomers are expected to wade into the market over the next five years.”

Boomer Housing Demand

There is no one-size-fits-all outcome as Canadian boomers age into retirement, especially when it comes to their decision about where to live. More than half (57%) of respondents said they would purchase a detached house if they were to buy, while 19 per cent said they would prefer an apartment/condominium. Fifty-two per cent of boomer homeowners said they would prefer to renovate their existing home rather than purchase another, and an additional 24 per cent said they would consider it.

Of the 35 per cent of boomers who say they are considering purchasing a primary residence in the next five years, 56 per cent say they would consider moving to a rural or recreational region. Twenty-eight per cent say they would consider purchasing a larger home than the one they currently reside in, 56 per cent would consider a similarly-sized property, and 63 per cent would consider downsizing. Respondents were able to choose more than one option. The most popular reason for downsizing is less home maintenance (71%). Other popular choices include the ability to free up money for things like retirement (39%), travel (29%), and to help their children purchase a home (9%).

“Turning full circle to those carefree, pre-children years, most boomers are looking for a home that requires less maintenance,” Soper continued. “Paradoxically, they also yearn for country living and don’t want to sacrifice living space. Look for the continued growth of managed communities in exurban and recreational regions.”

Working boomers largely did not consider their region affordable (65%) and 42 per cent said they would consider a move to a different city, near or during retirement.

Since the onset of the COVID-19 pandemic, more than 550,000 Canadian boomers (6%) have sold their homes or are in the process of selling, and at least 90 per cent said the global health crisis neither caused their plans of moving to be postponed nor expedited.

Homeownership and Personal Wealth

Seventy-five per cent of boomers own their own home, the majority of whom do not currently have a mortgage (64%). Seventeen per cent of boomer homeowners own more than one property, and 40 per cent have at least 50 per cent of their net wealth in real estate.

“The boomer generation strongly values home ownership, for good reason. Real estate has been very, very good to them,” said Soper. “Most are still working and their home equity has become the bedrock of retirement security. Financially confident, their next move is a matter of lifestyle choice.”

Seventy-eight per cent of Canadian boomers believe that home ownership is a good investment.

Boomers keep ‘bank of mom and dad’ open

As home prices continue to grow across the country, many young adults are turning to their boomer parents for help with a down payment on a property. Twenty-five per cent of boomers say they have or would consider gifting or loaning money to a child to help with the purchase of a home. In Vancouver, that figure reaches as high as 34 per cent.

“Over the past year, home values have appreciated sharply in virtually every market from coast to coast. Affordability is a major issue for young Canadians and with stricter mortgage stress test measures in place, they must clear higher hurdles,” Soper said. “Many are turning to the so-called ‘bank of mom and dad’ to achieve the dream of home ownership. The parental bank appears willing, even if it means delaying retirement.”

A recent Royal LePage and Sagen survey[3] of first-time homebuyers in Canada found that 62 per cent of respondents nationwide felt anxious about missing out on a property they wanted because of an insufficient down payment, before buying their first home. That figure increased to 75 per cent in Toronto and 69 per cent in Vancouver.

Seventy-nine per cent of Canadian boomers do not have children living in their home. This includes boomers who are not parents. Seventeen per cent of them have adult children living at home. Seven per cent of those surveyed said they have children aged 18 to 24, and 12 per cent said they have children 25 years of age or older living at home.

Of those who have children living at home, 43 per cent plan to stay in their current property once their kids have moved out. Meanwhile, 21 per cent said they do not foresee their children leaving.

By the end of this decade, all boomers will be 65 or older, which typically coincides with retirement in Canada. Twenty-seven per cent of boomers who are currently working said they would consider delaying retirement to help their children with a down payment on a home.

For all regional and national responses, click here: rlp.ca/table_boomersurvey2021

Regional Summaries

Atlantic Canada

Twenty-nine per cent of boomers in Atlantic Canada are considering purchasing a home within the next five years. Seventy-eight per cent of boomers in the Maritimes own their own home, the majority of whom do not currently have a mortgage (72%), which is among the highest rates in Canada.

“The affordability of real estate in Atlantic Canada allows homeowners to pay off their loans quicker and enter retirement mortgage-free,” said Glenn Larkin, sales representative, Royal LePage Vision Realty, in St. John’s, Newfoundland.

Sixteen per cent of boomer homeowners in the region own more than one property, and 21 per cent have at least 50 per cent of their net wealth in real estate. More than two-thirds (67%) of respondents said they would purchase a detached house if they were to buy, while 11 per cent said they would prefer an apartment/condominium.

“Although home prices are more affordable in the Maritimes, some first-time buyers are finding current market conditions challenging, as prices have appreciated at record rates, partially driven by a surge of out-of-province buyers over the last year,” continued Larkin. “Many parents with the ability to do so, are helping their children with a down payment. Often they are using some of the profit from the sale of their own family home.”

Nineteen per cent of respondents in Atlantic Canada are likely to assist, or have assisted, a child financially with the purchase of a home, the lowest rate of all surveyed regions in the country.

Forty-nine per cent of boomer homeowners in Atlantic Canada said they would prefer to renovate their existing home rather than purchase another, and an additional 26 per cent said they would consider it.

For all regional and national responses, click here: rlp.ca/table_boomersurvey2021

Quebec

Twenty-nine per cent of boomers in Quebec are considering purchasing a home within the next five years, which is among the lowest rates in Canada. At 62 per cent, Montreal has the lowest rate of home ownership among boomers. That figure rises to 67 per cent in the province, the majority of whom do not currently have a mortgage (57%). Sixteen per cent of boomer homeowners in Quebec own more than one property, and 34 per cent have at least 50 per cent of their net wealth in real estate.

More than half (53%) of respondents in Quebec said they would purchase a detached house if they were to buy, while 20 per cent said they would prefer an apartment/condominium.

Of the 29 per cent of boomers in Quebec who are considering purchasing a primary residence in the next five years, 62 per cent say they would consider moving to a rural or recreational region. Thirty-two per cent say they would consider purchasing a larger home than the one they currently reside in, 53 per cent would consider a similarly-sized property, and 59 per cent would consider downsizing (55% in Montreal). Respondents were able to choose more than one answer. The most popular reason among Quebec boomers for downsizing is less home maintenance (72%). Other popular choices include the ability to free up money for things like retirement (36%), travel (21%), and to help their children purchase a home (13%). Montreal respondents who are considering to downsize also value the ability to free up money for retirement (41%), travel (21%), and to help their children purchase a home (15%).

“While the expectation may have been that boomers would downsize into condominiums en masse, the proportion of Quebec boomers looking to move into a larger property is among the highest in Canada,” said Georges Gaucher, broker and owner, Royal LePage Village. “Although prices continue to rise in the Belle Province, it remains one of the most affordable markets in the country.”

Twenty-four per cent of respondents in Quebec are likely to assist a child financially with the purchase of a home.

Sixty-two per cent of boomer homeowners in Quebec said they would prefer to renovate their existing home rather than purchase another, among the highest rates of all the regions surveyed. An additional 21 per cent said they would consider it.

“We expect that as COVID-19 safety restrictions continue to be lifted and as the vaccination campaign progresses, some Quebec boomers will put their homes on the market, which will improve inventory selection for potential buyers,” added Gaucher. “However, while the variety of listings will improve, boomers who are selling are also expected to purchase. This will add more competition to the market.”

For all regional and national responses, including Montreal, click here: rlp.ca/table_boomersurvey2021

Ontario

Slightly higher than the national average, 37 per cent of boomers in Ontario are considering purchasing a home within the next five years (41% in Toronto). Seventy-six per cent of boomers in the province own their own home, the majority of whom do not currently have a mortgage (64% and 60% in Toronto). Sixteen per cent of boomer homeowners in the province own more than one property, and 46 per cent have at least 50 per cent of their net wealth in real estate. In Toronto that number reaches 54 per cent, the highest of all census metropolitan areas surveyed.

“The pandemic has left a lasting impact on many younger boomers who are trying to get more from their home after a year of COVID-19 related health restrictions. Many are looking for more space to entertain, help out with the grandkids or continue to work remotely. Not all boomers have the luxury to upgrade to a larger space, but the desire is there,” said Cailey Heaps, who leads the Heaps Estrin Team, Royal LePage Real Estate Services, in Toronto.

More than half (59%) of Ontario boomers said they would purchase a detached house if they were to buy, while 19 per cent said they would prefer an apartment/condominium.

Of the 37 per cent of boomers in Ontario who say they are considering purchasing a primary residence in the next five years, 56 per cent say they would consider moving to a rural or recreational region. Twenty-five per cent say they would consider purchasing a larger home than the one they currently reside in (26% in Toronto), 54 per cent would consider a similarly-sized property (57% in Toronto), and 66 per cent would consider downsizing (59% in Toronto). Respondents were able to choose more than one option. The most popular reason for downsizing is less home maintenance (73%). Other popular choices include the ability to free up money for things like retirement (38%), travel (35%), and to help their children purchase a home (11%). Toronto boomers who are considering to downsize also value the ability to free up money for retirement (49%), travel (42%), and to help their children purchase a home (16%).

Twenty-four per cent of respondents in Ontario are likely to assist a child financially with the purchase of a home (29% in Toronto).

“Boomers who own property in Ontario have seen their equity grow while making memories in their family home. They want the same experience for their children and feel a sense of urgency, as prices are becoming more out of reach, to help get them on the property ladder,” said Heaps. “While competition is high across the province, Toronto remains a particularly difficult market to get into because of the higher price point. For some younger buyers, help from parents will determine whether they can purchase at all.”

Fifty-two per cent of boomer homeowners in Ontario said they would prefer to renovate their existing home rather than purchase another, and an additional 23 per cent said they would consider it.

For all regional and national responses, including Toronto, click here: rlp.ca/table_boomersurvey2021

Prairies (Saskatchewan and Manitoba)

Thirty-two per cent of boomers in the Prairies are considering purchasing a home within the next five years. Home ownership among boomers is higher than the national average with 78 per cent of Prairie boomers owning their own home, the majority of whom do not currently have a mortgage (66%). Twenty-one per cent of boomer homeowners in the region own more than one property, and 35 per cent have at least 50 per cent of their net wealth in real estate.

“I’ve seen many cases where boomers have moved to their secondary properties on the lake in retirement, but they don’t always sell their primary residences,” said Norm Fisher, broker and owner, Royal LePage Vidorra, in Saskatoon, Saskatchewan. “Home prices are more affordable in Saskatchewan, so established homeowners can afford to keep both.”

More than half (57%) of respondents in the Prairies said they would purchase a detached house if they were to buy, while 26 per cent said they would prefer an apartment/condominium.

“Most boomers are not eager to move into a significantly smaller space, but they do want a home that requires less maintenance, and won’t be a burden on their family or friends if they choose to spend several months away in the winter,” said Chris Pennycook, sales representative, Royal LePage Dynamic Real Estate, in Winnipeg, Manitoba.

Twenty-four per cent of boomers in the Prairies are likely to assist their children financially with the purchase of a home.

“I’ve been in real estate for 35 years. Young people getting financial help to buy their first home is not a new trend, but I can’t remember a time when parents, and in some cases grandparents, have helped this much,” added Pennycook.

Forty-one per cent of boomer homeowners in the Prairies said they would prefer to renovate their existing home rather than purchase another. An additional 31 per cent said they would consider it.

For all regional and national responses, click here: rlp.ca/table_boomersurvey2021

Alberta

Forty-one per cent of boomers in Alberta are considering purchasing a home within the next five years. At 84 per cent, Alberta has one of the highest rates of home ownership among boomers, the majority of whom do not currently have a mortgage (67%). Thirty-six per cent have at least 50 per cent of their net wealth in real estate. Twenty-four per cent of boomer homeowners in the province own more than one property.

“Owning a second property is common in Alberta as either a recreational property or as an investment. Real estate is highly affordable and has great value. You can buy a condo in Edmonton’s city centre as a student rental for less than $130,000,” said Tom Shearer, broker and owner, Royal LePage Noralta Real Estate, in Edmonton.

More than half (58%) of respondents in Alberta said they would purchase a detached house if they were to buy, while 13 per cent said they would prefer an apartment/condominium.

“Boomers in Calgary typically belong to one of two schools of thought: those who want to age in place if they can, and those who want to downsize into a bungalow or villa-style community,” said Corinne Lyall, broker and owner, Royal LePage Benchmark, in Calgary. “Downsizing does not necessarily mean moving into a condo. The preference for most is to have a smaller house with less maintenance.”

Of the 41 per cent of boomers in Alberta who say they are considering purchasing a primary residence in the next five years, 55 per cent say they would consider moving to a rural or recreational region. Seventeen per cent say they would consider purchasing a larger home than the one they currently reside in, 58 per cent would consider a similarly-sized property, and 66 per cent would consider downsizing. Respondents were able to choose more than one option. The most popular reason for downsizing is less home maintenance (70%). Other popular choices include the ability to free up money for things like retirement (36%), travel (28%), and to help their children purchase a home (6%).

Twenty-nine per cent of respondents in Alberta are likely to assist a child financially with the purchase of a home.

“Many boomers have built up significant wealth in real estate. It is common to see parents give financial gifts to adult children to help them own their own home nearby. This allows them to support each other, as often we see grandparents helping out with their grandkids,” added Shearer.

Nearly half (49%) of boomer homeowners in Alberta said they would prefer to renovate their existing home rather than purchase another, and an additional 24 per cent said they would consider it.

For all regional and national responses, click here: rlp.ca/table_boomersurvey2021

British Columbia

Thirty-nine per cent of boomers in British Columbia are considering purchasing a home within the next five years.

“Boomers are the most affluent generation in Canadian history and appreciate the equity they have built up in their homes,” said Caroline Baile, associate broker, Royal LePage Sussex, in North Vancouver. “While many did not have an immediate need to move due to additional space requirements, as safety restrictions are lifted and the vaccine roll-out is in full gear, many boomers will again think about their next move.”

Seventy-nine per cent of boomers in the province own their own home (73% in Vancouver), the majority of whom do not currently have a mortgage (66% and 64% in Vancouver). In B.C., 18 per cent of boomer homeowners currently own more than one property, and 48 per cent have at least 50 per cent of their net wealth in real estate, one of the highest rates of all regions surveyed in Canada.

More than half (54%) of respondents in B.C. said they would purchase a detached house if they were to buy, while 19 per cent said they would prefer an apartment/condominium.

“The trend we’re noticing among this group is rightsizing, rather than downsizing. They may choose a slightly smaller home, but they still want some outdoor space and room to entertain,” continued Baile. “Townhomes are very popular today among younger boomers, who aren’t quite ready for a condo but enjoy the freedom of a property with lower maintenance.”

Of the 39 per cent of boomers in B.C. who say they are considering purchasing a primary residence in the next five years, half say they would consider moving to a rural or recreational region. Thirty-six per cent say they would consider purchasing a larger home than the one they currently reside in, 64 per cent would consider a similarly-sized property, and 59 per cent would consider downsizing. Respondents were able to choose more than one option. The most popular reason for downsizing is less home maintenance (55%). Other popular choices include the ability to free up money for things like retirement (45%), travel (30%), and to help their children purchase a home (9%).

Thirty-one per cent of respondents in B.C. are likely to assist a child financially with the purchase of a home. That number jumps to 34 per cent in Vancouver.

Forty-five per cent of boomer homeowners in B.C. said they would prefer to renovate their existing home rather than purchase another, and an additional 27 per cent said they would consider it.

For all regional and national responses, including Vancouver, click here: rlp.ca/table_boomersurvey2021

Posted on

September 21, 2022

by

Marie & Kim Taverna

More than one in ten homeowners in Canada’s three largest urban centres owns multiple properties

Highlights:

According to a recent Royal LePage survey[1] of 1,500 homeowners in Canada’s three largest urban centres – Greater Toronto Area (GTA), Greater Montreal Area (GMA) and Greater Vancouver (GV) – more than ten per cent of Canadians polled currently own more than one property (13% in GTA, 12% in GMA, 14% in GV).

“While some secondary properties are used for recreational purposes, many of these homes are foundational to Canada’s critical supply of rental housing,” said Phil Soper, president and CEO, Royal LePage. “Entrepreneurial landlords supply housing to the thirty per cent of Canadians who rent, be they new immigrants, students, young people entering the labour force, or those who cannot or choose not to own their home.”

Twenty-one per cent of secondary property owners in the Greater Montreal Area say they used equity from their primary residence to complete the purchase. That number doubles (42%) in the greater regions of Toronto and Vancouver, where home prices are significantly higher.

When asked about the purpose of their secondary properties, more than two thirds of respondents in Greater Vancouver (65%) and the Greater Toronto Area (64%) said they were collecting rental income, if only some of the time. In the Greater Montreal Area, that number decreased to 35 per cent.

Witnessing home values across the country rising to new heights, younger Canadians who are financially able to purchase one home are confident in purchasing a secondary property as an investment. Eighteen per cent of homeowners aged 18 to 35 in the Greater Toronto Area own more than one property. In the Greater Montreal Area and Greater Vancouver, 16 per cent and 14 per cent of that age group own more than one property, respectively.

Greater Toronto Area

In the Greater Toronto Area, 27 per cent of secondary property owners said they were not collecting any rental income at all, while 49 per cent said they are using the unit solely as a rental property. Fifteen per cent said they were using the property some of the time and renting it out some of the time. Seven per cent of respondents said their secondary properties are currently vacant.

“Canadian homeowners believe in the value of real estate because they have seen their investments grow over time,” said Karen Millar, sales representative, Royal LePage Signature Realty. “People feel confident investing in real estate because it is a physical entity that they can experience. Although the market may see peaks and valleys, homes have historically generated wealth in the long run.”

In the Greater Toronto Area, 18 per cent of homeowners aged 18 to 35 currently own more than one property, while 11 per cent of homeowners over the age of 35 own more than one property.

“Young buyers are looking to capitalize on the real estate market by investing in a property that will appreciate over time. I have many younger clients who have purchased condos or smaller homes for as little as $300,000 outside of Toronto, in areas like Guelph and London, where the rental market is very active among students,” added Millar. “Parents of students in Ontario’s university towns are also taking advantage of the local rental market, purchasing a property – often times with multiple units – for their children to stay in while studying and also as a source of rental income from other students.”

A recent Royal LePage survey of Canadian boomers (chart), those born between 1946 and 1965, found that 54 per cent of the cohort in the Greater Toronto Area have at least half (50%) of their net wealth in real estate. Twenty-nine per cent say they have or would consider gifting or loaning money to a child to help with the purchase of a home. Another Royal LePage survey of Canadians aged 25 to 35 (chart) found that 93 per cent of the Torontonians in this age group consider home ownership a good financial investment.

Greater Montreal Area

In the Greater Montreal Area, where properties are more affordable than in the other two major urban centres surveyed, 37 per cent of secondary property owners said they were not collecting any rental income at all, while 25 per cent said they are using the unit solely as a rental property. Nine per cent said they were using the property some of the time and renting it out some of the time. Four per cent of respondents said their secondary properties are currently vacant.

“Among secondary property owners in Montreal, the majority are using the properties for leisure, like recreational purposes, rather than as an investment,” said Roseline Guèvremont, real estate broker, Royal LePage Tendance. “In Toronto and Vancouver, where prices have been soaring for several years, homeowners have been taking advantage of the significant equity in their primary residences in order to purchase a secondary property, and renting it out at least part of the time as an investment. In Montreal, although the real estate market has begun to catch up in recent years, prices remain considerably more affordable, so buyers can purchase without necessarily leveraging equity from a primary residence.”

In the Greater Montreal Area, 16 per cent of homeowners aged 18 to 35 currently own more than one property, while 11 per cent of homeowners over the age of 35 own more than one property.

Guèvremont noted that younger buyers are becoming more and more interested in owning property, whether to improve their quality of life, to generate new sources of revenue, or to have new experiences.

“Confidence in the Montreal real estate market has continued to rise in recent years, and many clients have expressed to me their preference to invest in brick and mortar properties. For younger buyers, it’s much more straightforward than investing in the stock market.

“With the return of in-person classes this fall and the opening of the border to U.S. visitors, demand is already being renewed in the rental market,” said Guèvremont. “Montreal’s real estate investors had a tough time generating profits from their units over the last year due to COVID-19.”

A recent Royal LePage survey of Canadian boomers (chart), those born between 1946 and 1965, found that 41 per cent of the cohort in the Greater Montreal Area have at least half (50%) of their net wealth in real estate. Twenty-four per cent say they have or would consider gifting or loaning money to a child to help with the purchase of a home. Another Royal LePage survey of Canadians aged 25 to 35 (chart) found that 92 per cent of Montrealers in this age group consider home ownership a good financial investment.

Greater Vancouver

In Greater Vancouver, 27 per cent of secondary property owners said they were not collecting any rental income at all, while 51 per cent said they are using the unit solely as a rental property. Thirteen per cent said they were using the property some of the time and renting it out some of the time. Seven per cent of respondents said their secondary properties are currently vacant.

“Real estate is an integral part of retirement planning for many Vancouver homeowners,” said Caroline Baile, real estate broker, Royal LePage Sussex. “While some are using their secondary properties, possibly a cottage or a ski chalet, many of those with multiple homes are looking to build future equity as a means of sustaining a desired lifestyle down the road. Investment properties are not likely being used to subsidize monthly income, but are seen as a long-term investment.”

In Greater Vancouver, the country’s most expensive city to buy real estate, 14 per cent of homeowners aged 18 to 35 currently own more than one property. Similarly, 14 per cent of homeowners over the age of 35 own more than one property.

“Younger Canadians are sitting in the driver’s seat of their own futures. They are very business savvy, and have a clear idea of what they want their retirement years to look like. Young people today put a lot of emphasis on work-life balance. They want their money to work for them, and they recognize that investing in real estate has the potential for great returns,” continued Baile. “While so many young Canadians struggle to enter the real estate market, those fortunate enough to do so, whether on their own or with financial support from their parents, will reap the benefits in the future.”

Posted on

September 21, 2022

by

Marie Taverna

Six in ten non-homeowner millennials in Canada believe they will one day own a home, but half say they would have to relocate: Royal LePage Survey

Survey highlights:

–According to a recent Royal LePage survey[1], conducted by Leger, 60 per cent of Canadian millennials, people aged 26 to 41, who do not currently own a home believe they will one day. Of them, however, 52 per cent say they would have to relocate in order to achieve this milestone; one their parents seem to have reached with greater ease. Canada’s chronic housing supply shortage continues to challenge buyers of every age, especially those looking to enter the market.

When broken out by age, 62 per cent of respondents under the age of 35 say they believe they will own a home one day, compared to 56 per cent of those aged 35 and up. Meanwhile, 25 per cent of non-homeowner millennials across the country do not believe they will ever own a home.

“Many Canadians who are in the stage of life where homebuying is a top priority, especially younger millennials, remain committed to achieving home ownership and are optimistic about the opportunities that lie ahead, due in large part to the example of their parents and family members who have reaped the benefits of our nation’s historically strong real estate market,” said Phil Soper, president and CEO, Royal LePage. “Currently the largest proportion of our population, and so arguably the most impactful, millennials are a resilient group who are willing to make the necessary sacrifices in order to reach this milestone.”

According to the survey, 57 per cent of Canadian millennials are already homeowners. That figure is higher among those aged 35 and up (63%). And, 51 per cent of the cohort plan to purchase a home within the next five years – whether their first home, a move-on property or a secondary residence – which means more than 4 million[2] young Canadians will be looking to make a purchase between now and 2027. Almost half of them (45%) will be first-time homebuyers. Of the millennials who plan to buy their first home or sell their current home and move within this period, 47 per cent say they will remain in their current city or town, while 41 per cent say they plan to relocate.

“The need for a significant increase in the supply of housing in Canada has not gone away. While we are currently seeing a slowdown in market activity, as prospective buyers temporarily put their home purchase plans on pause while they seek to understand the full impact of rising interest rates and inflation on their bottom line, we expect that activity will rise again, although not at the same rate we saw throughout 2021 and early 2022. The return of these sidelined purchase intenders, a growing population, largely from increased immigration levels, together with household formation changes – individual households made up of boomer parents and their millennial children evolving into two, three or four households – will require more available housing stock to ensure a balanced market and to help bring affordability back within reach of many Canadians,” continued Soper.

Competition for properties and the prevalence of multiple-offer scenarios may have eased in recent months, however, young buyers continue to face significant challenges, as the cost of borrowing has become a barrier to affordability for many first-time buyers.

“Policy makers should take note that between millennial demand, immigration and the growing pipeline of those who could not transact over the last two years, more supply is required. We could see another surge in price appreciation, following short-term economic softening, when these sidelined purchase intenders transact.”

According to the survey, of the millennials in Canada who do not own a home, 68 per cent feel that home ownership is important. That figure is higher among those under the age of 35 (72%).

“While affordability remains a challenge, Canada continues to see strong demand from millennials who, like their parents, see home ownership as a right of passage. The desire to be a homeowner remains strong among Canadians of all ages. Despite the harsh reality many young people are facing – that buying their first home today is more difficult than it was for their parents – the majority still value home ownership and see it as a long-term investment in their futures,” said Soper.

In a 2021 survey of Canadian boomers, Royal LePage found that 25 per cent of those aged between 57 and 76 would help, or have already helped, their children financially with the purchase of a property[3].

When it comes to relocation, 72 per cent of millennials in Canada say that if the cost of living was not an issue, they would choose to continue living in their current city or town. However, 46 per cent do not believe their salaries will increase at a rate that will allow them to buy a home in their current location. This result appears to be reflective of lifestyle choice, rather than proximity to their place of work. Forty per cent of millennials say they would change employers to be able to work fully remotely. The top motivators for wanting to work from home are high commuting costs, long commuting times and traffic, and the ability to manage household duties while working from home.

“Employment and migration trends have intersected with real estate market trends over the last two years. The irreversible impact that the pandemic has had on our workforce and the manner in which employees do their jobs sparked a shift in the mentality of many Canadians, especially young professionals, who are reprioritizing their lives and their plans for the future,” said Soper. “Strong real estate demand is no longer concentrated in the major centres, but has expanded to many suburbs and exurbs where homebuyers can purchase larger, more affordable properties, as the tolerance for commuting wanes and the desire to have more flexibility in the hours and location one works increases.”

Twenty per cent of millennials in Canada say their ideal work/life scenario would be to live outside the city and work fully remotely; the most popular answer of all options offered. The second most popular option is to live in the city and work fully remotely (14%).

Royal LePage 2022 Demographic Survey: Canadian Millennials – Data chart:rlp.ca/table_2022-millennials-report

|

Subscribe with RSS Reader

Subscribe with RSS Reader